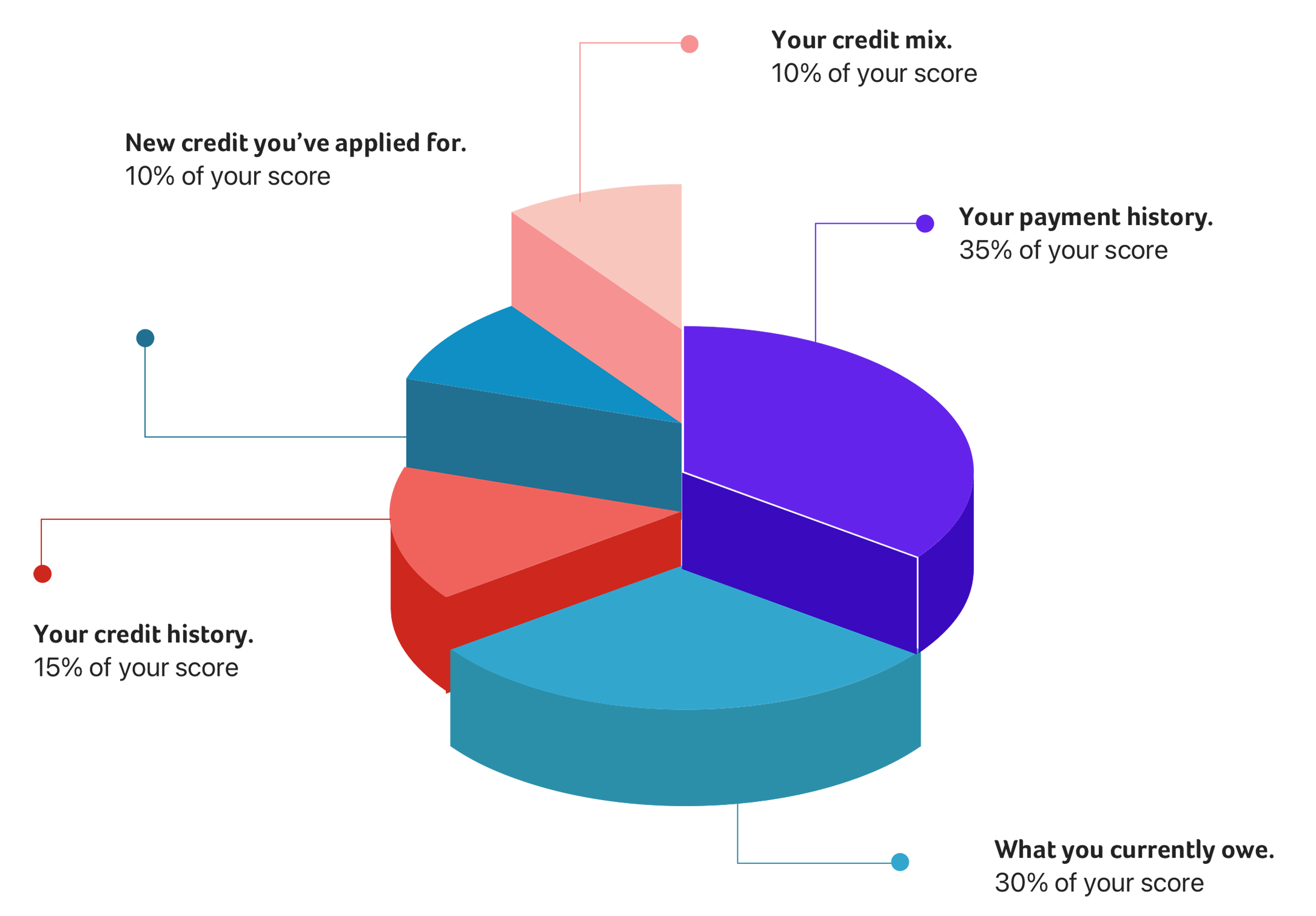

Your payment history.

(35% of your score)

The most important factor. A record of paying bills on time shows you can be trusted.

What you currently owe.

(30% of your score)

Having some debt isn’t a problem. Approaching the maximum of existing lines of credit may appear risky.

Your credit history.

(15% of your score)

How long you’ve had credit accounts and how recently you’ve used them. If you’re a young borrower, no worries — you’ll build your history over time.

Your credit mix.

(10% of your score)

Credit cards, car and mortgage loans, retail accounts, etc. There’s no perfect mix but demonstrating that you can manage a range of different credit lines looks good.

New credit you’ve applied for.

(10% of your score)

This is a small factor but applying for multiple new lines of credit may raise cause for concern.