Creating financial security with an emergency fund

No money saved up for emergencies? You’re not alone. According to Bankrate, approximately one in four people in the U.S. report having no emergency savings. With nothing set aside, 25 percent of Americans say they put unexpected expenses on credit cards. This behavior can lead to crippling debt, making it hard to develop healthy savings habits.

Why do I need an emergency fund?

It’s good to have an emergency fund because everybody has unexpected expenses sometimes. Common needs for an emergency fund include a home or car repair, a medical treatment or prescription, child-related expenses, or an overlooked bill.

Also consider the risk of losing your job. Or, if you have a seasonal job, think about having an emergency fund to get you through times when you make less money. Keep in mind, while unemployment and other types of insurance may help people in certain situations, insurance processes can take a long time. You could experience weeks or months with no income. An emergency fund could help cushion the blow if you lose a job or the ability to work.

If you’re thinking about using credit cards or loans to pay unexpected expenses, you may want to reconsider. While credit cards or loans can help you handle emergency expenses in the moment, they can set you off-course financially for months. Here are some reasons why:

- High interest rates on the amount you charge or borrow – This means you could end up paying back much more than you originally needed.

- Time lost building your emergency fund – For every month it takes to climb out of debt, you could be putting money into your emergency savings.

Emergency fund vs. savings

So, emergency fund vs. savings: What’s the difference? Savings refers to the overall act of saving and the multiple methods you can use to save money. Having an emergency fund is one aspect of savings because it involves setting money aside, not to be used or commingled with your spending money.

There are generally two types of emergency funds:

- Liquid emergency savings fund. This is often an amount between $100 and $1,000. It’s called “liquid” because it can be accessed easily (liquidated). Think of your liquid emergency fund as cash you can use if your pet needs an emergency treatment, or your car suddenly needs a new tire.

- Full emergency savings fund. This is a savings fund to cover three to six months of expenses if you were to lose your job or ability to work. A full emergency savings fund takes a while to build because it’s based on whatever it costs to live your life on a monthly basis (times three months, six months, etc.) To determine the amount needed, you must add up all your monthly expenses like housing, transportation, utilities, phone/internet, groceries, even debt. Also consider:

- Do you share these expenses or carry them by yourself?

- Would you be able to defer or eliminate any of them if you had to?

Easy Access to Funds

Emergencies don't wait for bank transfers! With funds on your Wisely card, access money when you need it.

For many people, building a full emergency savings fund feels overwhelming. That’s why it’s recommended to start small with a liquid savings fund allowing you to practice saving in the short term while still having a long-term goal of building a full emergency savings fund.

Of course, there are other types of savings that are longer term, such as retirement savings accounts like 401(k)s and 529 accounts to help save for future child education costs. These are unique types of savings methods in accounts that are structured to build wealth over time.

How should you use an emergency fund vs. savings?

You should use an emergency fund when you have an expense that could jeopardize your monthly cash flow and disrupt your budget. A good time to use your emergency fund might be when an unexpected expense could cause you to:

- Overdraft your bank account

- Charge a credit card or take out a loan

- Be late/miss paying bills

Savings, on the other hand, is generally for specific goals. Maybe you have savings set aside just for family trips. The money is reserved until it’s time to go on vacation.

Get Wise

Imagine the things you hope you won't have to pay for but potentially might have to. These are great reasons to build an emergency fund.

Imagine the things you hope you won’t have to pay for but potentially might have to. These are great reasons to build an emergency fund.

How to build an emergency savings fund

If saving is a new habit for you, take it slow and start small. Saving money is a mindset, so the key is to implement a healthy financial behavior that builds over time. It’s also something to practice repeatedly until it becomes a way of life. You’ll get there!

Here’s how to start building your emergency fund:

Create a dedicated account

Set up an account just for savings. Having a dedicated account such as a prepaid card that’s separate from your primary spending account reminds you that you’re building up your financial cushion. It also makes it easier for you to track your savings.

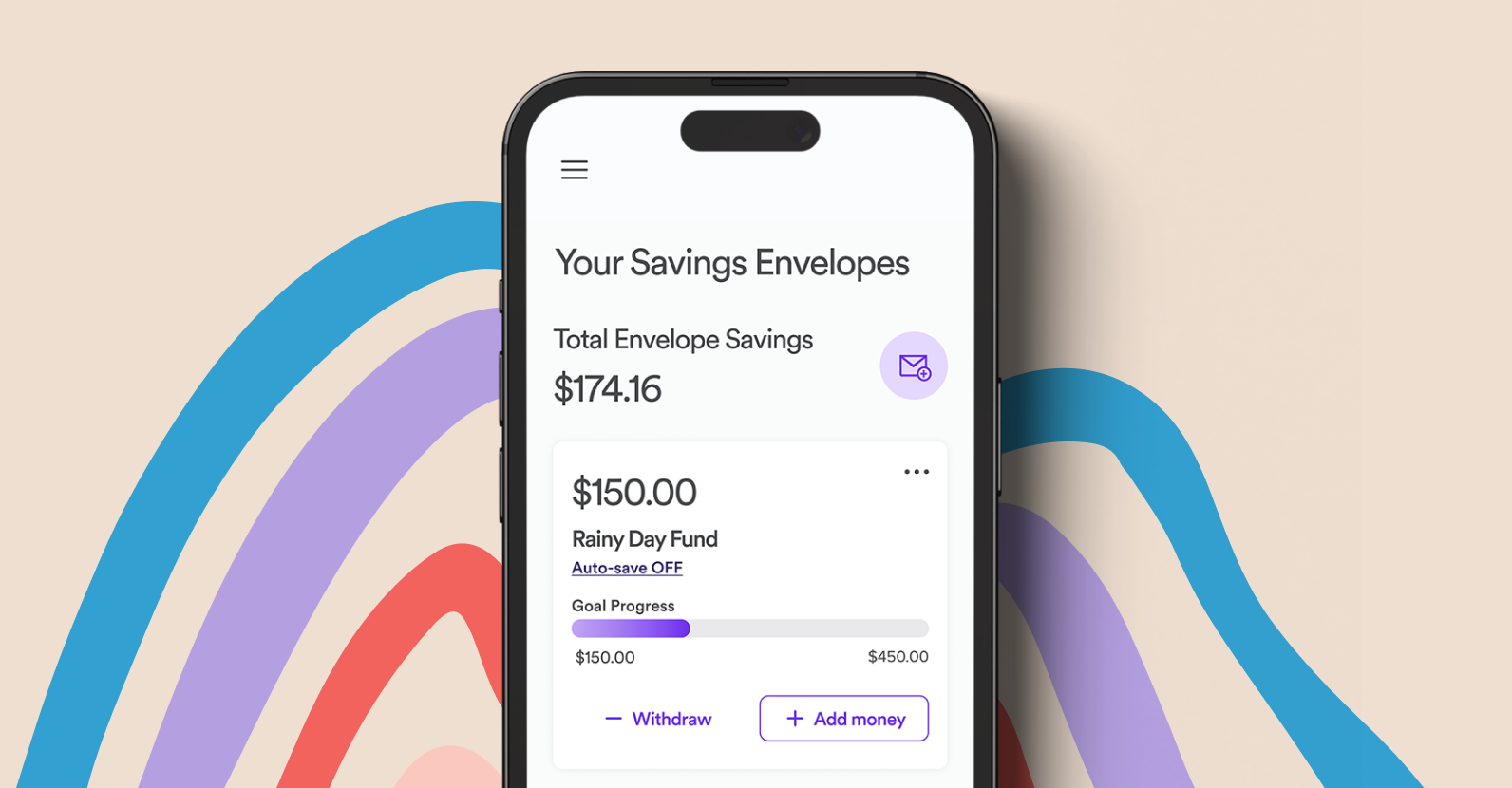

Use multiple savings folders

Using savings folders or envelopes is a helpful way to build your emergency savings. Savings envelopes allow you to create different “categories” for your savings goals and manage those funds. Think of having one envelope as your liquid emergency savings fund, another for family vacations, and perhaps another for medical emergencies.

Automate your savings

When you automate your savings, you’re saving money without really thinking about it. Paycheck splitting and auto-transfer are easy ways to do this.

First, determine how much money you’re willing to save each paycheck. Maybe it’s only $10 or $20 for now. Saving that small amount automatically is an easy way to build up your savings without needing to remember to transfer money each payday. The money is automatically set aside so you won’t even miss it from your paycheck.

“But what if I never have enough money to save because I need every single penny I earn?”

A lot of people feel this way. After taxes are taken out and you’ve paid all your bills, it might seem like there’s hardly anything left.

It may be hard to imagine now, but you could autosave just $5 a paycheck for starters. This is the value of automatic transfer to savings. Next thing you know, you’ll have $25 in your emergency fund, then $50, then $100.

If you dip into it before it grows, just start over until you develop an emergency fund mindset: An emergency fund is only for emergency expenses.

Having a liquid emergency savings fund is the first step on the journey to long-term financial success and freedom from stress that goes with it.

Seasoned saver? You may be ready for multiple savings goals, like growing your liquid emergency savings fund while also putting money in your full emergency savings fund.

Your main goal is to keep developing a savings mindset and become a better saver. Having a liquid emergency savings fund is the first step on the journey to long-term financial success and freedom from stress that goes with it.

Saving Made Easy

Split deposit and Wisely Savings Envelopes1 make saving easy. Organize savings into envelopes1 assigned as different categories you create. Keep in mind: Even $10 a week adds up to over $500 a year!

What’s a good emergency fund amount to have?

For a liquid emergency fund, you can start with $100.

One hundred dollars is a small cushion to have on hand for when something comes up. Maybe you get sick unexpectedly and need money for a copay. The hundred dollars may prevent you from charging on a credit card or taking a loan.

Next, aim to grow your liquid fund to $500 and ultimately to $1,000. Having $1,000 in your liquid emergency savings fund will give you newfound confidence when it comes to being financially prepared for life’s emergencies.

To grow your full emergency fund to cover expenses of three to six months, you’ll need to be patient. Let’s suppose all of your household and monthly expenses add up to $2,000. Now multiply that by three or six. If you set up an automatic savings transfer of $100 per month, in one year you will save $1,200. Therefore, it will take several years to grow your full emergency fund. To make it less overwhelming, you can break up your long-term goal into shorter milestones so you feel accomplishments along the way.

Where to keep an emergency savings fund

Some people choose to keep emergency savings in a bank or credit union account, usually in a separate account just for emergencies.

Others find it useful to keep an emergency savings fund on a prepaid card. Having emergency money available on a prepaid card offers several benefits:

- Easy access to your funds if you need them

- A single prepaid card that can be used for a single purpose, like savings

- A card that allows you to spend only what’s on the card

Some people prefer to put larger savings amounts into an interest-earning savings account so the money can grow along with their progress.

The most important thing is to figure out an organized savings system that works for you. You may want to write down your savings plan on a piece of paper first to organize your thoughts around your savings categories and goals.

Once you’re clear on your savings goals, you can decide where to keep your emergency savings fund and how to distribute the savings on a weekly, biweekly, or monthly basis.

Choose Wisely

Plan today for tomorrow’s unplanned. With Wisely you'll have access to automatic savings envelope1 transfers for when life hands you the unexpected expenses.

An emergency fund takes time to build

Remember, saving is a journey. Sometimes you won’t be able to save. Other times, you’ll need to dip into your savings when an unexpected expense pops up. Don’t feel bad about using your savings; that’s what it’s there for! Saving is a process of building it up, using it when you need it, and rebuilding it again. By setting goals based on your circumstances and needs, you can feel confident knowing you’re always on the right path.

When to use your emergency fund

Deciding when to use your emergency fund is a personal decision based on your level of need. Only you can decide what is a true emergency in your life, whether it’s an unpaid bill that’s urgently overdue, or your child needs something for school. The goal is to avoid spending money on high-interest credit cards or loans to get you through times of crisis.

Ask yourself:

- Is there any other way I can pay for this unexpected expense?

- Do I really “need” this expense right now or is this just something I really “want”?

- How will my cash flow be impacted if I pay for this expense out of my regular account?

One way to determine when to use your emergency fund is to get really clear about your needs vs. wants. Oftentimes, people enjoy watching their emergency fund grow, but then decide since they don’t have any emergencies happening it’s okay to go ahead and spend that money.

This is a time to flex your money muscle!

Building your emergency savings fund is like building a muscle. Weak muscles make it easy to drop the “weight” and just let go. Strong muscles make it easier to keep doing your reps (and building your emergency fund). No excuses. Plus, you’ll love the feeling of being able to meet those emergency expenses without impacting your monthly cash flow.

You'll love the feeling of being able to meet those emergency expenses without impacting your monthly cash flow.

Should I use my emergency fund to pay off debt?

Paying off debt is a critical aspect of creating financial stability and freedom. But so is having an emergency fund.

What if you paid down your debt with your emergency fund, only to have an unexpected expense that you can’t pay? How would you pay for that expense? You’d probably put it on a credit card or take out a loan. This starts the debt cycle all over again.

To decide if it’s really worth it to use your emergency fund to pay debt, first assess how much is in your emergency fund vs. how much debt you owe. If you’ve got a small amount of debt and a decent-sized emergency fund, it might make sense to pay off the full debt amount.

These are personal decisions. You have to think about how quickly you can build up your emergency savings again if you choose to pay down debt – and how much you’re willing to risk if an unexpected expense comes up.

What to do if you’ve used up your emergency savings fund

Savings funds are there to be used. Sometimes you’ll need to use a little while other times you may need to use a lot. If you’ve used up all of your emergency savings, try, try, try again! Keep building your emergency savings with healthy financial behaviors you’ve already learned, like autosaving and paycheck-splitting. Just be consistent and keep going.

By The Wisely Team

By The Wisely Team

Ready to build your emergency savings? Get started with a Wisely card.

Footnotes

- Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance using the myWisely app or at mywisely.com. ↩

This content is for informational purposes only and may have been derived, with permission, from a third party. While we believe it to be accurate as of the date of publication, it does not constitute the rendering of legal, accounting, tax, or investment advice or other professional services by ADP and it is being provided without any warranty whatsoever. Please consult with appropriate professionals related to your individual circumstances.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2025 ADP, Inc. All rights reserved.

By clicking 'Leave', you will exit myWisely and be directed to a third party website which may have different privacy and security settings.