Letting people know you’re on a budget could help you save

Have you ever felt pressured to go out for an expensive meal with friends or buy pricey concert tickets because “everyone” is going? Perhaps you were too embarrassed to let people know you didn’t want to spend your money that way. Or maybe you went along anyway, only to feel like you were moving further away from your financial goals.

Now thanks to the emerging trend of loud budgeting, you might find it a whole lot easier to stick to a budget and feel more empowered around your finances.

Pay Bills Wisely

Get ahead of paying your bills1 with the myWisely app.2 Schedule payments in advance to help avoid any applicable late fees.

What is loud budgeting all about?

What’s the story behind loud budgeting? TikTok Influencer, Lukas Battle, started this personal finance social media trend when he coined the term “loud budgeting” to challenge the prevailing messaging around “quiet luxury.” Quiet luxury refers to the things you’re constantly invited to spend money on, from products in your social media feed to invitations to meals and outings.

But giving in to all those luxuries could be what’s keeping you from achieving your financial goals. So, what does loud budgeting mean in practice?

The idea behind the loud budgeting movement is to get “loud” about what you’re budgeting for and why, in order to more effectively meet your financial goals. This means letting friends, family and work colleagues know you’ve got a budget, and you’re being decisive about how you wish to spend (or not spend) your money. You are quite literally “loud budgeting,” meaning you’re vocally taking control of your financial situation. The loud budgeting trend has since gone viral, empowering people to say no to extravagances they can’t afford.

But budgeting out loud isn’t about not being able to afford things. It’s all about choice. It means communicating with confidence that you have certain financial goals in mind and you’re unwilling to sacrifice them.

To loud budget, start by having a budget

To get comfortable telling people you’re loud budgeting, you must first create a budget for yourself. Budgeting doesn’t have to be complicated. It just has to accurately reflect how much comes in and what goes out every month.

Some people write down expenses and income with good old-fashioned pen and paper. Others prefer to use a basic budgeting spreadsheet or free apps that could help you track your expenses and income.

Whichever method works best for you, first gather up all of your monthly needs. These are your need-to-pay items, which may include:

- Rent or mortgage

- Car loan or transportation expenses

- Insurance

- Mobile phone and internet

- Utilities (gas, electricity, water)

- Groceries

Once you’ve established your monthly expenses, you can see how much is left over for saving and spending. If you haven’t already started an emergency fund, it’s critical to make this part of your loud budgeting plan.

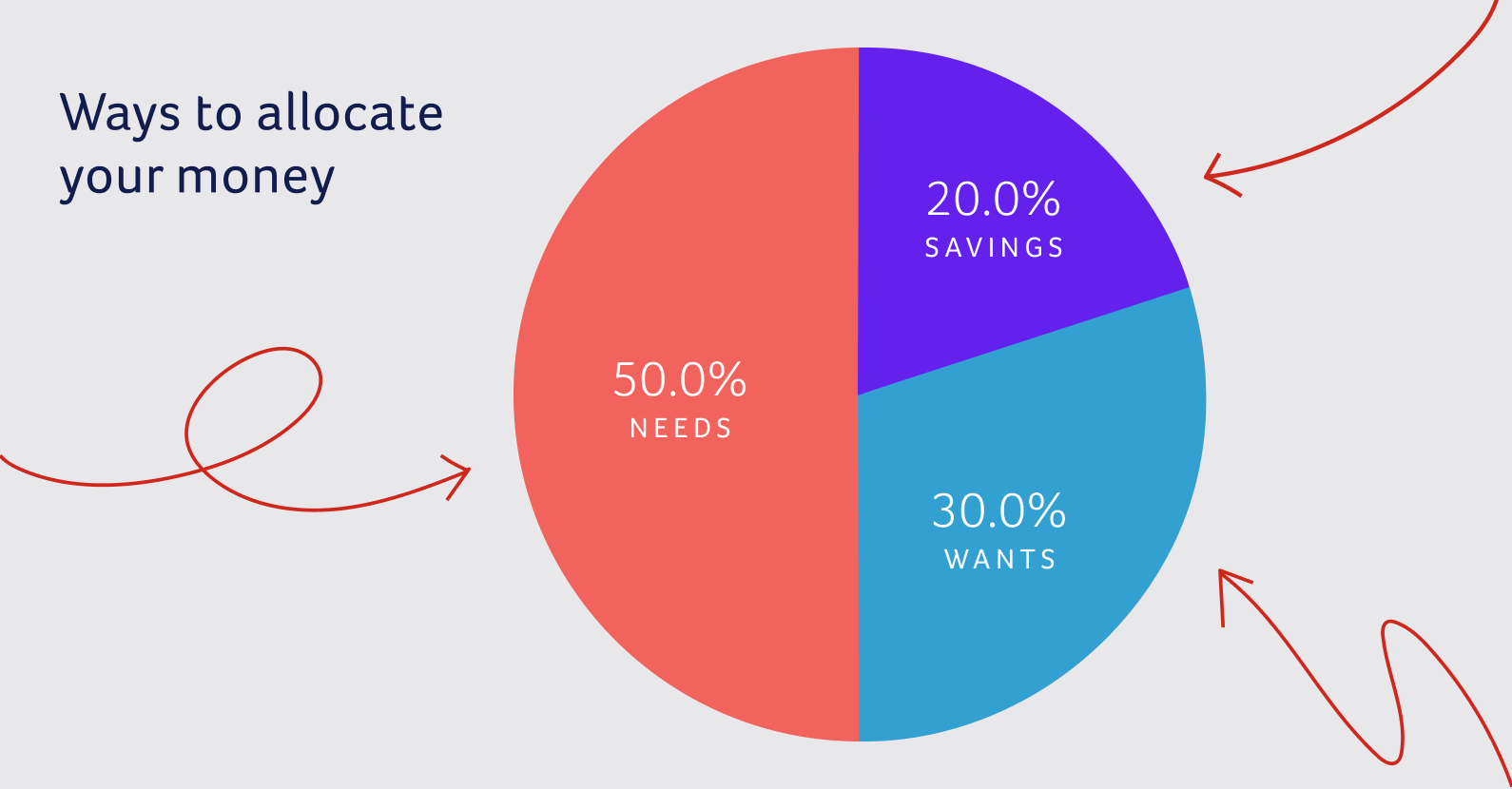

Here’s a good rule of thumb for allocating your net income (what you receive after taxes are taken out):

50% for needs

These are bills that must be paid and expenses you must cover every month or semi-monthly, such as housing, transportation, insurance, credit card bills, and groceries.

30% for wants

This is money for you to spend on things you enjoy, like going to the movies, getting a cup of coffee, or eating out with friends.

20% for savings

These are funds you set aside for something you’re saving up for, such as a trip or a big-ticket item. Savings could also be money you put into an emergency fund, or in a 401(k) or other type of retirement account.

You can always change the numbers around if you wish. For example, you may want to allocate 30% for savings and 20% for wants. Keep in mind that when it comes to loud budgeting, examples like this are only meant to guide you. Create your own loud budget based on your own financial strategy, spending habits, and other factors unique to your budget and lifestyle.

Once you’ve determined your needs and you’ve organized your savings, it’s time to figure out how to spend your money. If you’re constantly paying bills and trying to save money while not allowing yourself much enjoyment in life, you may start to feel deprived. You could even end up resenting the whole budgeting process. Be sure to build “wants” into your budget for the enjoyable things in life that are important to you.

By creating a budget, you’ll know how much money you have allocated each month for eating out or buying yourself a new pair of shoes. Then when an invitation arises, you can determine whether it fits within your budget or not.

Easy loud budgeting tips

Until you’re comfortable living on a budget and “getting loud” about it, you may find it challenging at first. Loud budgeting requires a shift in mindset and a bold new way of letting people know about your financial goals.

Here are some tips for making your loud budget heard:

1. Get real.

For many people, overspending has a lot to do with getting caught up in the “shoulds.”

- I should be able to afford this.

- I should be able to go there because everyone else is going.

- I should be able to buy what I want because I work hard for it.

Let go of the comparisons. We tend to compare ourselves to others, yet we have no idea what other people’s financial lives really look like. Don’t worry about why or whether others are spending. Focus on your own money and financial future.

2. Get creative.

Still want to hang with your friends without missing out? Come up with alternate ways to spend time together without spending too much money. Consider options like these:

- A potluck gathering at your house

- A coffee date instead of a dinner date

- A book club that brings you together once a month

- A one-day road trip close to home

- Pooling funds for a trip together

In general, look for ways to make your get-togethers less about spending money and more about spending time.

3. Get loud.

Your loud budgeting definition will be different from someone else’s, which means loud budgeting requires effective communication. When you are loud budgeting, let everyone in your life know, and why. This is a way of establishing a boundary: what is acceptable to you and what is not.

You need to clearly define loud budgeting to the people in your community. This means setting boundaries and in some cases, having an honest talk with your loved ones about your spending limits. Make it clear that your money boundaries are integral to managing your finances and ultimately, reaching your long-term money goals. People will come to learn and respect your financial boundaries.

It might not be easy at first, especially when people expect you to always go along, or you feel as though you’re the only person in the group who is sticking to a budget. People might try to convince you to break your budget “just this once,” but keep practicing loud budgeting:

“I’d love to go to the baseball game with you, but right now I’m saving up for my summer vacation. Going to see a ball game isn’t in my budget at the moment, but why don’t you come over to my house and we’ll watch the game together sometime?”

With time and practice, loud budgeting will become a healthy financial habit. You may even influence others to start loud budgeting themselves.

How loud budgeting contributes to a healthier money mindset

Loud budgeting is all about living within your means – and on your terms. Feeling empowered around money is a significant factor in cultivating a healthy money mindset and building financial stability.

Loud budgeting also means placing savings goals ahead of spending. The main idea is to let people know you are serious about saving and you’re using loud budgeting to support you in reaching your goals. Communicating freely about finances may help build financial confidence and minimize feelings of embarrassment or anxiety when you’re standing ground on your budget.

How loud budgeting might help you save money

Once you start loud budgeting, it might help you follow your budget, pay down debt, and contribute more towards your savings. Let’s look at the ways loud budgeting could potentially help you save money:

Sticking to a budget vs. just “having a budget.”

It’s one thing to have a budget; it’s another to let people know that you’re sticking to it. When you share your financial goals and turn down purchases or opportunities that don’t support your goals, it may be easier to stay on budget. Budgeting is a lifelong, healthy financial behavior that helps build financial stability.

Paying greater attention to paying down debt.

If you’re loud budgeting and staying tuned into your expenses vs. income, you could find yourself more focused than ever on paying down debt that’s been hanging over your head. When you pay off your debt, you could have more money for savings.

More seriously committing to savings.

Setting up automatic transfer to savings is a sign of financial stability. It shows you’re just as serious about saving as you are about paying your bills. Loud budgeting could support you in being a better saver. When you live by a budget based on needs, wants and savings, you may find it easier to say no to things that aren’t within your budget. Even better, you could start building your emergency savings fund or fill it more quickly.

Save More Wisely

Set up automatic transfer to your Savings Envelope3 where you can easily organize savings into different categories.

Is loud budgeting for you?

Perhaps you’re serious about saving but you keep getting thrown off course. Loud budgeting could be the solution. By sharing openly about what you choose to spend your money on and what you don’t, you may find support among friends and family. It’s enough to let people know why you might be turning something down, starting with “I’m loud budgeting.”

Keep in mind, you have every right to budge on your budget if an unexpected, can’t-miss opportunity comes along. You be the judge of whether it’s something that can’t be missed, or whether it’s something that could wait.

Ready to get started?

Loud budgeting starts with a budget. Figure out your income vs. expenses, use the 50/30/20 rule, and practice loud budgeting the next time something comes up that’s not in the budget.

Get loud about budgeting. Wisely helps you control your finances.

Footnotes

- While this feature is available without a fee, certain other transaction fees and costs, terms, and conditions are associated with the use of this card. Please log in to the myWisely app or mywisely.com to see your cardholder agreement and list of all fees for more information. ↩

- Standard message fees and data rates may apply. ↩

- Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app or at mywisely.com. ↩

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2025 ADP, Inc. All rights reserved.