Learn the budgeting basics

Struggling to make your money last all month? A basic budget might help.

There are many money management tips out there, but starting off with budgeting basics and establishing a solid foundation for your personal finances can the best way to set yourself up for success.

Budgeting is all about knowing how much money goes out compared to what comes in. Having a budget can be empowering because it helps give you control over your money rather than feeling like money (or lack of it) is controlling you.

So how do you create a basic budget? And more importantly, how do you stick to it? Read on to learn all about the basics of budgeting, including how to start budgeting as a beginner and long-term budgeting tips that will help you stick to your strategy.

How to do a basic budget

Budgeting doesn’t have to be complicated. The main idea is to know exactly where your money goes so you can better plan for unexpected expenses, manage your spending, live within your means, and make adjustments to potentially help you save more.

Here are some basic budgeting steps to follow:

1. Assess all income sources.

This is where you add up how much money you bring in after taxes (your take-home income). It should include income from multiple sources if you have more than one job. It should also include any additional income received, such as child support or social security. If you have automatic withholdings for things like healthcare or a retirement savings plan (e.g., 401K), your net income should reflect total take-home income after those “expenses” are taken out.

2. Evaluate your fixed expenses.

Fixed expenses are the ones that generally stay the same, month after month. These often include:

- Rent or mortgage

- Car payments and insurance

- Health and/or medical coverage

- Mobile phone and internet

- Student loan or tuition payments

It’s important to know exactly what your fixed expenses are every month so you can effectively budget.

3. Write out all your variable expenses.

Variable expenses include those that you must pay every month, similar to fixed expenses, as well as personal spending. With variable expenses, the amount you spend could change somewhat from month to month. Let’s say you depend on electric heat in the winter, but you live in a climate that doesn’t require you to use air conditioning in the summer. Your electric bill may be higher during cold weather months and lower during the summer.

To determine the average monthly expense for utility bills, for example, look back over the last 12 months. Add up the total for one year, then divide by 12 to get the monthly average.

Other examples of variable expenses include:

- Gasoline – Your gas expenses may be roughly the same from month to month if you’re just commuting to work or driving around town. But be sure to plan ahead if you have a long road trip coming up that requires higher spending on gas.

- Groceries – This may be semi-fixed or variable, depending on your shopping habits. Your grocery bill could be higher one month, for example, because you have friends or family staying with you.

- Health and medical care and prescription drugs – Do you have a doctor’s visit that requires a copay? Or maybe you have a prescription that needs to be refilled every 90 days. Evaluating your budget every month can help you more accurately plan for variable expenses.

- Entertainment – The amount you spend on dining out, grabbing a coffee, or participating in various activities may fluctuate depending on the month.

- Personal care – Think about all the times you seem to run out of everything at once, such as shampoo, toilet paper and cleaning supplies. These variable expenses can add up quickly so keep an eye on household products and plan for spending as needed.

- Pet needs – You may have a fixed expense in mind to handle basic pet needs, such as food and other supplies. But what about your pet’s annual vet visit? Sometimes you may need to set aside more for certain types of pet expenses. An emergency fund can also help when you have an unexpected trip to the vet.

4. Track everything.

Try using a basic budget template or an app that shows where your money is going and keeps you informed about your finances in real-time. When you can visibly see where money is going, it may be easier to eliminate or reduce expenses and potentially put more towards saving. Consider tracking your income vs. expenses for 30 days until you get the hang of basic budgeting. Then try tracking for 60 days, 90 days and so forth. The more you track, the greater control you may start to have over your finances.

5. Monitor your money.

To become financially stable, it’s important to have a strong understanding of not only budgeting basics, but your specific financial behavior as well. Money monitoring–that is, tracking your spending and saving and making adjustments as you go–is a healthy financial habit that can support you on the path to financial stability.

Track Wisely

Track your spending with the myWisely® app.1 See your spending trends in different categories.

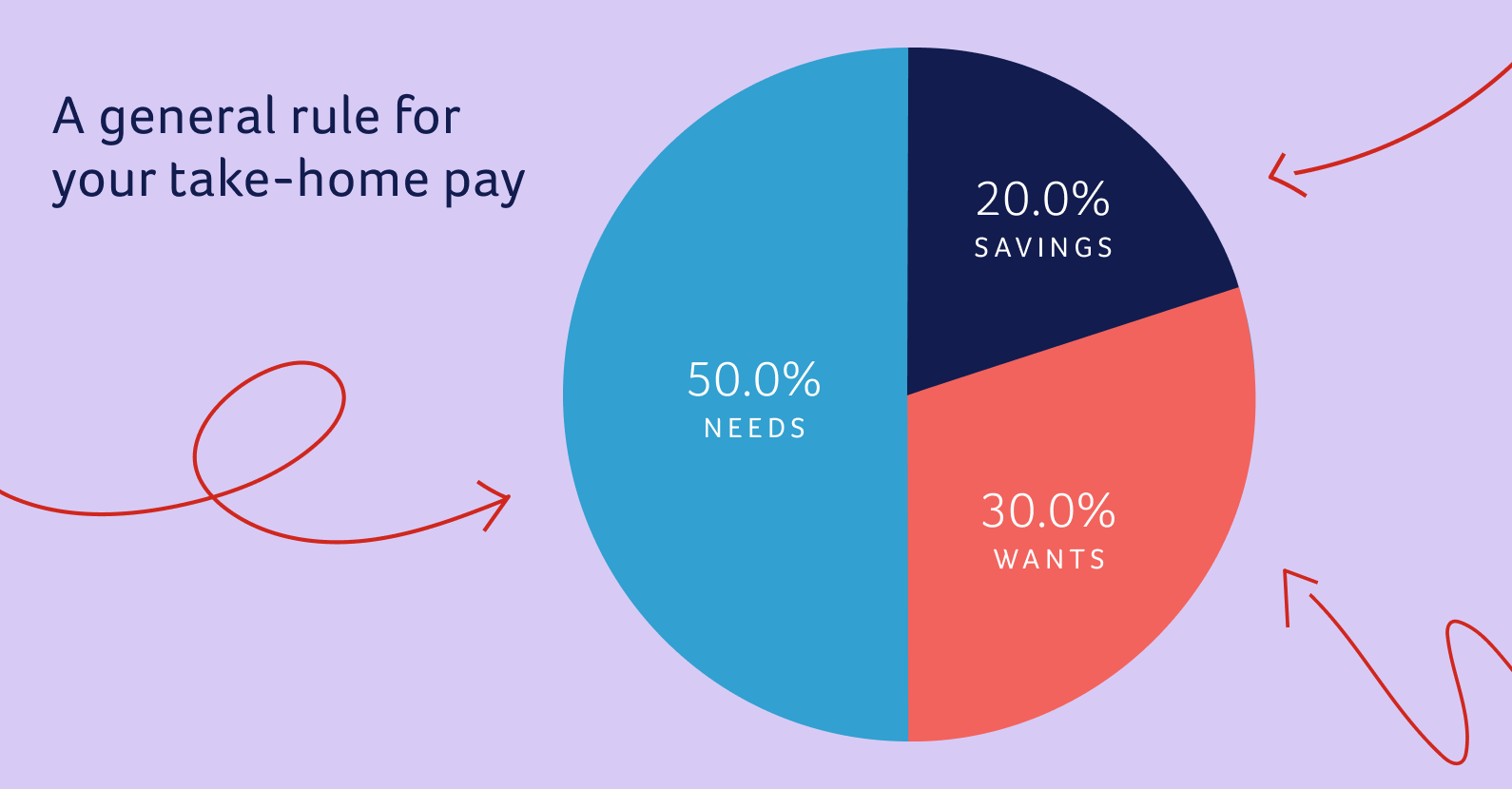

50% on needs (fixed and variable expenses), 30% on wants (things you enjoy in life), and 20% into savings

How to deal with budgeting challenges

Budgeting requires commitment. People sometimes start off with a budget but feel like giving up when they overspend or the budget seems too restrictive.

Here are some common budgeting challenges and how to deal with them:

Underbudgeting

Underbudgeting is when you don’t give yourself enough cushion in case you spend more than planned for the month. This can happen when you only budget for exact amounts without taking into consideration expenses that might pop up that you haven’t planned for. This narrow focus neglects the budgeting basics principle of preparing for the unexpected, which can help manage fluctuations in your monthly income and expenditures.

When you have an emergency fund, of course, you can potentially offset budgeting challenges. But it’s also wise to build in a small reserve from each paycheck.

Let’s say you get paid $1,500 every two weeks. If your fixed and variable expenses add up to exactly $1,500, there’s no room for error or unexpected changes to your budget. To avoid underbudgeting, consider rounding up your variable expense amounts. If your grocery bill is usually $200 every two weeks, for example, try budgeting for $250 instead. At the end of two weeks, if you didn’t need that extra $50 for groceries, you could move into savings.

Sticking to a budget

When first learning how to manage money, some people take an all-or-nothing approach to budgeting. Going off your budget for a week or a month may feel like a failure, but it’s not. As long as you keep getting back to your budget, you’ll develop new financial behaviors that can improve your ability to spend money wisely over time. If you underbudget one month, you can learn from your mistake and budget better the following month.

One budgeting strategy that has gained popularity is loud budgeting. The main idea behind loud budgeting is to let friends, family and coworkers know you’ve got a budget and you’re committed to sticking to it. This often means sharing that you’re unwilling to sacrifice your budget for short-term enjoyment.

Monitoring your budget

Things change. Your income may vary. You may have more medical office visits than you had in the past or you may have fewer household expenses this year than you had last year. Monitoring where every dollar is spent is key to success in budgeting, helping you adjust expectations and ensuring that your financial plan aligns with actual purchasing habits —not just what you expect to spend. Your budget should reflect your current and near-future financial needs, so it’s critical to regularly re-evaluate your spending categories.

If you have acquired debt, you may also want to reallocate funds so you can make higher credit card payments. This might mean cutting back on variable expenses like eating out so you can still save money while paying down your debt.

Budgeting basics for greater savings

One of the best things about learning how to make a budget is that it can help you better plan for savings. By being able to see where you’re spending money, you can also see where to cut back and/or reallocate funds toward savings.

Budget for an emergency fund

Building an emergency fund is an important step towards financial stability. By setting aside money for life’s unexpected expenses, you can help protect your cash flow.

Start small if you need to, setting aside just $10 from every paycheck. Increase your emergency fund savings as you get more comfortable with budgeting and making savings a priority.

Budget for regular savings

You have fixed expenses and variable expenses. Why not make savings a fixed expense every month or every two weeks, depending on how often you get paid? Begin with small amounts, making minor adjustments that can collectively lead to significant savings without being overwhelming. When you start to see savings as an automatic expense, you may be able to grow your savings more quickly and feel more confident about your budgeting skills.

Automatic transfer to savings

One way to enforce savings as an expense is to set up automatic transfers to savings. This allows you to have a certain amount of money transferred from your regular account into a separate savings account or savings envelope. Your savings builds automatically each time you get paid.

Smarter Savings with Wisely

Set up automatic savings transfers. Categorize money into savings envelopes2 with the myWisely app.1

Basic budgeting takes practice

By now you’ve heard it multiple times: Budgeting takes practice – and patience. Learning how to create a budget doesn’t have to feel like forever, and it doesn’t have to be perfect. Every time you feel like you’ve made a mistake or you’re not able to stick to a budget, remind yourself this is all part of your financial wellness journey.

By the Wisely Team

By the Wisely Team

Make basic budgeting a habit.

Get on track with Wisely.

Footnotes

- Standard message fees and data rates may apply. ↩

- Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance using the myWisely app or at mywisely.com. ↩

This content is for informational purposes only and may have been derived, with permission, from a third party. While we believe it to be accurate as of the date of publication, it does not constitute the rendering of legal, accounting, tax, or investment advice or other professional services by ADP and it is being provided without any warranty whatsoever. Please consult with appropriate professionals related to your individual circumstances.

The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc.

Copyright © 2025 ADP, Inc. All rights reserved.

By clicking 'Leave', you will exit myWisely and be directed to a third party website which may have different privacy and security settings.